In this week’s Stock Market Special, we unpack the parallels between today’s AI boom and the dot-com bubble, explore how the biggest tech firms are investing in each other’s futures, and examine whether markets can ever be truly efficient.

The AI Boom vs the Dot-Com Bubble

The surge in AI-related stocks has led many to ask whether a bubble is forming. Nvidia, Microsoft, and other tech giants have driven global markets to record highs, echoing the optimism of the late 1990s dot-com era. Back then, investors poured billions into internet startups that promised a digital revolution, but most lacked profits or even viable business models.

Today’s AI firms, by contrast, are already generating substantial revenue. Nvidia’s chips power much of the AI infrastructure, while Microsoft and Amazon earn billions from cloud computing. That said, investor behaviour often rhymes with history. Valuations have soared, expectations are sky-high, and phrases like “new economic era” are reappearing, the same language heard in 1999.

The key difference is in real-world applications. AI’s impact runs from productivity tools to healthcare innovation, but when expectations run ahead of reality, even solid technology can face corrections. Whether this is a bubble or a structural economic shift may depend on how quickly AI delivers genuine returns.

The AI Investment Web

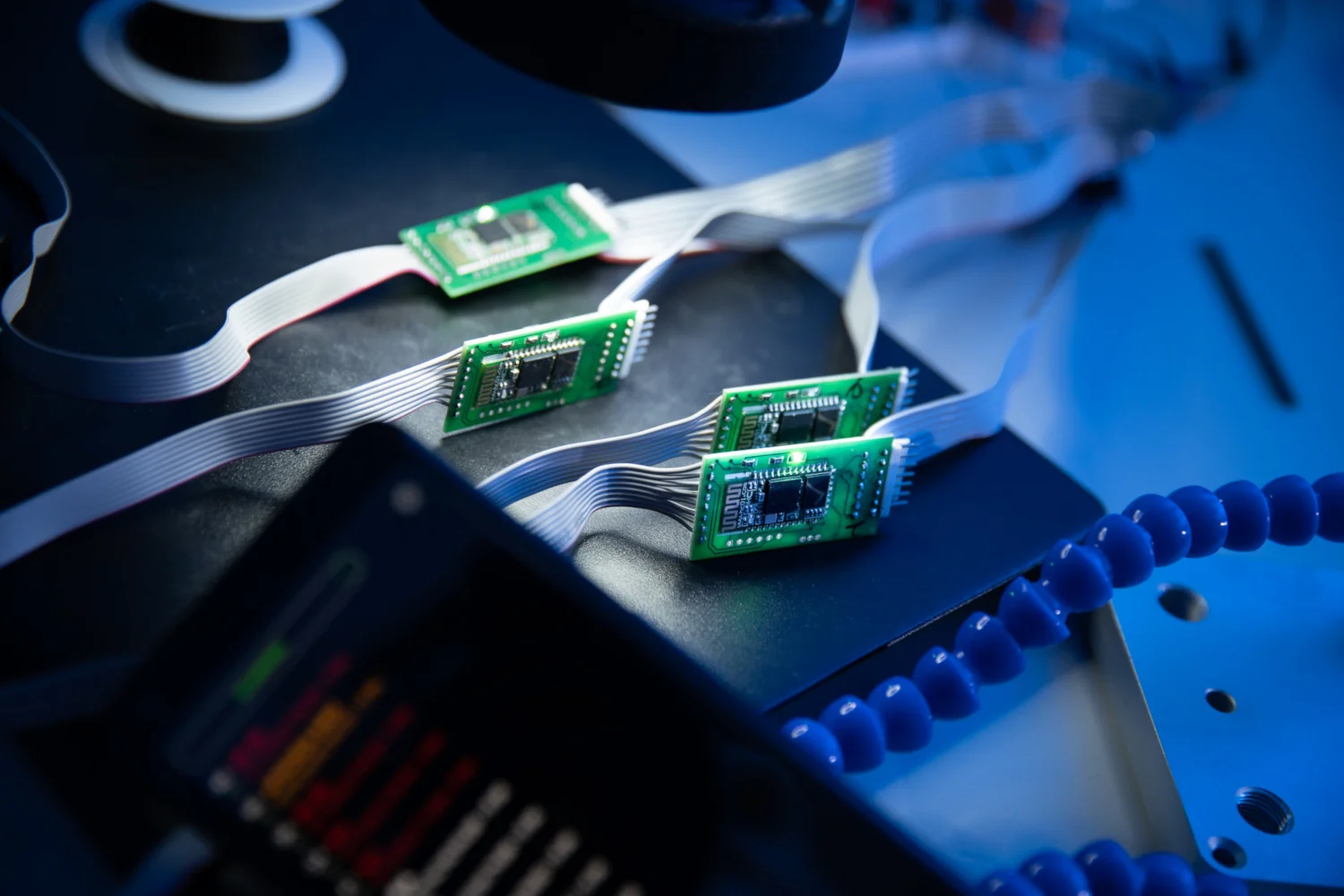

Behind the AI boom lies a complex web of investment and cooperation between tech giants. OpenAI, the company behind ChatGPT, recently invested in chipmaker AMD. Nvidia, meanwhile, announced a $5 billion investment into Intel, and has deepened partnerships with Oracle to expand AI cloud capacity.

This shows how AI growth is evolving. The main constraint is no longer ideas or algorithms, but the infrastructure needed to support them, chips, data centres, and energy supply. Unlike the dot-com boom, where many firms built websites without revenue, today’s leaders are investing heavily in the physical foundations of future growth.

Valuations, however, still reflect the optimism to an extent. Nvidia trades at around 35 times expected earnings, high, but not as extreme as the dot-com era, when many tech firms exceeded 100x despite no profits. This suggests the recent boom isn’t unfounded, though markets tend to become too optimistic during upturns.

These interlinked investments show the AI race is about control as much as innovation. By securing supply chains and partnerships, firms are betting that the AI revolution will be long, and costly, but worth it.

Are Markets Efficient?

In theory, markets are supposed to be efficient. The Efficient Market Hypothesis (EMH) suggests that prices always reflect all available information, making it impossible to consistently “beat the market.” But real-world behaviour often tells a different story.

The current AI boom is a perfect example. Every investor knows the same headlines, AI is transforming industries, Nvidia is dominating chips, yet prices still swing wildly. That’s because markets are driven by sentiment, as well as information. Even in an era of instant data, investors remain human, and excitement, fear, and the desire not to miss out play a role.

History shows that markets tend to overreact in both directions. They become too optimistic during booms and too pessimistic during downturns, only finding balance later. The EMH helps explain why timing markets is so difficult, but it doesn’t account for how collective psychology shapes them.

Understanding this matters for ordinary investors, too. It means price movements don’t always reflect logic, sometimes, they reflect mood. Recognising that helps you stay calm when others panic, and cautious when others are euphoric.

Unpacked

Market bubble – when asset prices rise far above their actual economic value, driven by speculation and excitement rather than fundamentals.

Price-to-earnings ratio (P/E) – a measure of how expensive a stock is, comparing its market price to its earnings.

Efficient Market Hypothesis (EMH) – the idea that markets always price in all available information, making it impossible to consistently outperform them. This is disputed as human sentiment is a big factor, often causing market prices to vary from their intrinsic value.

📣 Enjoying The Fiscal Compass?

If you enjoyed this Stock Market Special, please share it with someone who’d find it useful, subscribe to The Fiscal Compass for clearer insights, and follow on Instagram (@thefiscalcompassofficial) for more breakdowns.

Image credit: LHS Magpie