On one side, technology and artificial intelligence continue to fuel record market highs and investor optimism. On the other, traditional sectors such as energy and commodities are cooling sharply, hinting at weaker demand and structural shifts in global growth. What could it all mean for businesses, investors, and households?

💻 Could OpenAI Be Preparing for a Seismic IPO?

OpenAI, the company behind ChatGPT, is reportedly exploring a public listing that could value it at up to $1 trillion, potentially by late 2026 or 2027. If realised, it would rank among the largest initial public offerings (IPOs) in history and mark a turning point for the artificial intelligence (AI) industry. The company recently completed its transition into a for-profit structure, paving the way for external investors to buy in once it lists. For many, this would be the first real opportunity to directly invest in the AI revolution that has so far been dominated by private capital and a handful of major tech firms such as Microsoft.

A trillion-dollar valuation raises important questions. Does it reflect genuine long-term potential or speculative optimism around AI? Investor enthusiasm for the sector remains extraordinary, but valuations often front-load future growth, meaning expectations could be hard to meet. Still, an OpenAI IPO would likely reignite capital flows into AI-related firms and hardware providers, reinforcing the broader tech rally.

For businesses, AI tools are becoming a standard productivity lever, and a successful IPO could accelerate adoption further. For investors, it could reshape portfolio allocations as AI becomes a core exposure, not a niche theme. And for households, it may signal a new phase of digital transformation, one that increasingly touches how we work, learn and interact every day.

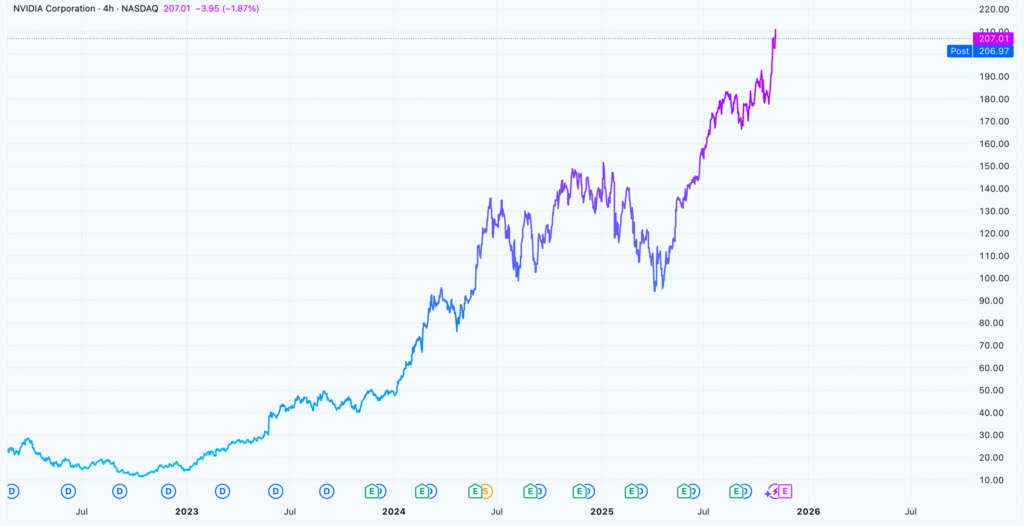

Nvidia Hits $5 Trillion

Nvidia has become the first company in history to reach a market capitalisation of $5 trillion, a figure larger than the annual GDP of every nation except the United States and China. It’s a remarkable milestone for a company that, less than a decade ago, was best known for gaming graphics cards. Today, its dominance in producing high-end chips for AI training and data centres has made it the central infrastructure provider of the AI era.

Nvidia’s remarkable stock price growth. From $40 a share in mid 2023 to over $200 a share now. That’s a rise of over 400%. Chart: TradingView

The key question is whether this valuation is justified by fundamentals. Nvidia’s revenues and profits have surged thanks to insatiable demand for AI-computing power, but markets have a habit of pricing in not just strong performance, but perfection. The company’s valuation now implies years of continued exponential growth, a tall order in a cyclical industry vulnerable to shifts in demand, competition, and regulation.

Yet Nvidia’s scale tells a deeper story about the current economy. Markets are concentrating value into a handful of tech giants whose products underpin global innovation. The company’s rise reflects investors’ conviction that AI is not a short-term trend but a structural transformation of how economies function. However, it also suggests growing vulnerability, if sentiment towards AI or chip demand weakens, markets more broadly could face sharp corrections.

🛢️ Energy and Commodity Surplus Heading into 2026

While the tech sector soars, the energy and commodity markets are facing the opposite trend. The International Energy Agency projects a record oil surplus of around 4 million barrels per day by 2026, while the World Bank expects global commodity prices to fall to a six-year low. This surplus stems from several converging factors: slowing global growth, improving energy efficiency, and increased production from major oil exporters. At the same time, policy uncertainty, particularly around the green energy transition, has tempered long-term investment, leading to an uneven supply-demand balance.

For economies reliant on commodity exports, such as those in the Middle East, Africa, and parts of Latin America, a prolonged price slump could squeeze public finances, depress investment, and slow development. However, cheaper commodities can be a positive, especially for households and manufacturers. Lower oil and gas prices help reduce transport and energy bills, easing the relentless inflationary pressure of the past few years.

As the digital economy booms, the resource-based side of the global economy faces oversupply and weaker demand. For policymakers, this mix complicates inflation management as headline prices may fall, but imbalance between sectors could persist.

💼 Unpacked

For-profit vs Non-profit – A for-profit entity exists to generate income for its owners or shareholders, while a non-profit reinvests any surplus into achieving a social or charitable mission. For-profits benefit from easier access to investment, faster growth, and higher pay potential, but face pressure to prioritise profits. Non-profits enjoy public trust and tax advantages yet often struggle to raise capital and scale.

Cyclical industries – Industries that are sensitive to the overall market climate, performing well in expansionary periods and performing poorly during downturns.

Does market cap accurately reflect value?

Market cap reflects what investors think a company is worth, share price multiplied by total shares. It can be inflated by hype, speculation, or future growth expectations. A company’s fundamentals, like earnings, assets, and cash flow, may tell a different story.

📣 Stay Up to Date

If you found this breakdown useful, share this article and subscribe to The Fiscal Compass for weekly insights delivered straight to your inbox.

Check us out Instagram (@thefiscalcompassofficial)andX (@FiscalCompass) for quicker snapshots into the economy.

Image credit: IOTWORLD