Growth forecasts are being revised up, interest rates are coming down, and inflation is easing, yet uncertainty still hangs over the global economy. This week’s data tells a more nuanced story. Global growth is holding up, but it’s uneven. Some regions are adapting quickly to higher rates and tougher competition, while others are falling behind.

🌎 Global Growth Picture

Goldman Sachs expects the global economy to grow by around 2.8% in 2026, slightly faster than the 2.5% many other forecasters are predicting. At first glance, that sounds reassuring. But global growth doesn’t mean every country is expanding at the same pace. It’s a weighted average, combining strong performers with weaker ones, and the differences matter.

This forecast reflects an economy that is slowing compared to the post-pandemic rebound but not stalling. Inflation is expected to remain relatively contained, allowing central banks to gradually lower interest rates rather than keep them restrictive. That alone has important implications. Lower rates ease pressure on borrowers, support investment, and reduce the risk of policy mistakes tipping economies into recession.

The composition of growth matters as much as the headline number because it tells us where momentum is actually coming from. In the US, growth is being supported by easing financial conditions, which is making it cheaper for households and businesses to borrow and invest, alongside low tariff drag. China’s position looks very different. A current account surplus of around 1% of GDP indicates that the country is still producing far more than it consumes, relying heavily on exports to sustain activity at home. That imbalance doesn’t stay contained within China’s borders. It shapes global trade flows, intensifies competition for manufacturers elsewhere, and puts pressure on economies that struggle to match China’s scale and cost advantages.

Taken together, this outlook describes a world economy that is stable but fragmented. Growth exists, but it is concentrated. Some regions are adapting well to shifting trade patterns, while others are struggling to keep up. Understanding where growth is coming from helps explain why policymakers are making the decisions they are, and why some economies feel far more fragile than the global numbers suggest.

🇪🇺 Why is the Euro Area Continuing to Lag Behind

One of the clearest weak spots in the global outlook is the euro area. While the world economy is expected to keep growing, Europe is forecast to underperform, and this isn’t a short-term problem. It reflects deeper structural issues that have built up over years.

Economic growth ultimately depends on productivity, innovation, and the ability of firms to scale. On these fronts, Europe has fallen behind other wealthy economies. Business formation is slower, capital markets are more fragmented, and regulation often prioritises stability and consumer protection over speed and risk-taking. These choices are not accidental. European policymakers have consistently favoured social protection, environmental standards, and precautionary regulation. Those priorities bring real benefits, including stronger worker protections and higher baseline standards of living.

The downside is that they can make adaptation harder in a rapidly changing global economy. Competition from China has intensified, particularly in manufacturing and green technologies, where Chinese firms benefit from scale, state support, and cost advantages. European firms are finding it difficult to compete on price, while regulatory complexity raises costs further.

This matters because weak growth limits policy flexibility. Governments with sluggish economies have less fiscal space, and central banks must be more cautious about tightening financial conditions. As global competition increases, Europe risks becoming a region that consumes innovation rather than creates it. That doesn’t imply inevitable decline, but it does explain why Europe consistently features as a drag in global growth forecasts, even when the wider economy appears relatively resilient.

🇬🇧 The Bank of England cuts rates, but uncertainty remains

Against this global backdrop, the Bank of England’s decision to cut the Bank Rate to 3.75% was widely expected. Inflation has fallen faster than anticipated, economic growth contracted in October, and unemployment is still rising. On paper, these conditions point clearly toward looser monetary policy.

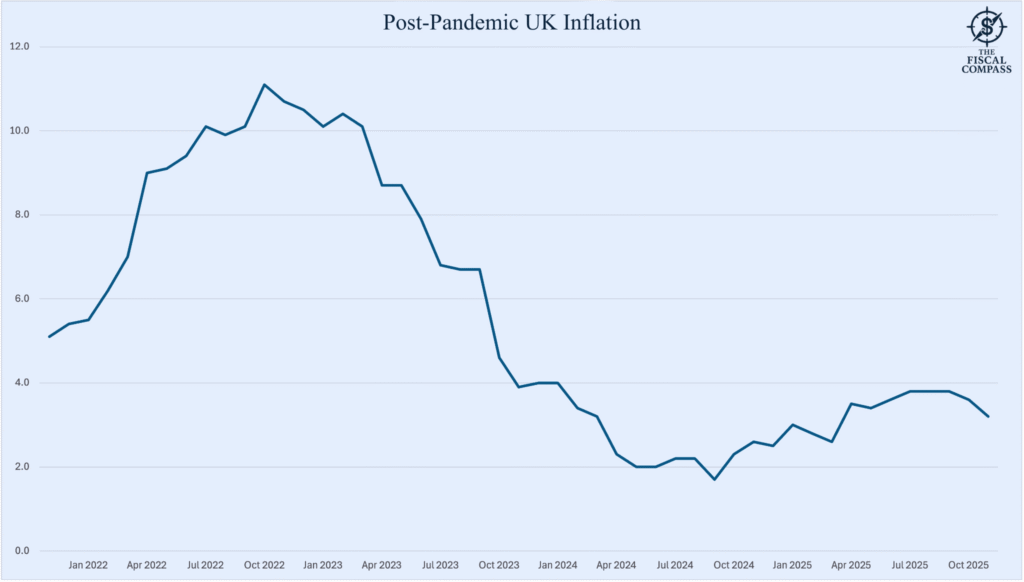

The Bank of England feel comfortable enough with the post-pandemic decline in inflation to continue rate cuts. This comes after two months of falling inflation after the uptrend from September 2024 to July 2025. Data: ONS

What stood out was not the cut itself, but how narrowly it passed. A 5–4 vote suggests deep unease within the Monetary Policy Committee. Some members remain concerned that inflation could prove more persistent, particularly in wages and services, while others worry that cutting too slowly risks unnecessary economic damage. This split reflects the difficulty of policymaking in an environment where the data is improving, but confidence remains fragile.

For households and businesses, the direction of travel matters more than the exact vote count. Lower interest rates reduce pressure on mortgage holders and gradually ease borrowing costs. However, the hesitancy signals that rate cuts are likely to be cautious rather than aggressive. The Bank is trying to balance the risk of reigniting inflation against the risk of holding the economy back for too long.

This caution mirrors the global picture. With inflation moderating and growth uneven, central banks are moving toward lower rates but not rushing. Forecasts suggest UK rates could fall further to around 3% by mid-2026, broadly in line with the US and other advanced economies. Conditions are improving, but the margin for error remains small.

💼 Unpacked

Global Growth

Global growth refers to the combined rate at which the world’s economies are expanding. It’s calculated by weighting each country’s growth by the size of its economy. This means strong growth in large economies like the US or China can lift the global figure, even if many smaller or weaker economies are slowing.

Tariff Drag

Tariff drag describes the economic slowdown caused by import tariffs. Tariffs raise the cost of goods, reduce trade volumes, and disrupt supply chains. Over time, this weighs on business investment and consumer spending, slightly lowering economic growth compared with a world where trade is more open. The US is expected to have low tariff drag, allowing their economy to continue to grow.

Current Account

The current account measures a country’s trade in goods and services, plus income flows such as dividends and interest, with the rest of the world.

📣 Support The Fiscal Compass

If you found this breakdown useful, consider sharing it with someone who wants a clearer view of what’s happening beneath the headlines. You can also subscribe to The Fiscal Compass to receive future posts straight to your inbox, and follow along on social media for short, practical updates on how the economy affects everyday decisions.

Instagram: @thefiscalcompassofficial

X (Twitter): @FiscalCompass

LinkedIn: Vinay Meisuria

Goldman Sachs Global Economic Outlook 2026

Featured Image: European Union flags, Flickr